FreeTrade Review

- Fussy Vegans

- Jul 25, 2021

- 4 min read

If you're interested in making your money work harder than in a standard savings account you could choose to invest it. If you take that path, you can give the money to a robo-investor like Wealthify who do everything for you - have a read of our review of them here. Or, you could choose to do it yourself. That's where a platform like FreeTrade comes in. Years ago, you would have had to speak to a financial advisor and they've take a huge cut of your investments, or more recently you could turn to someone like Hargreaves Lansdown, who charge you a large sum for every transaction you make and then charge you a small cut of your portfolio every so often. Platforms like FreeTrade are revolutionising the investment industry because the fees are so small, the barriers to entry are disappearing.

Both of us have FreeTrade accounts because, while Wealthify is great, sometimes we want to choose our own investments and this sort of thing is right up James' street - he finds it all very interesting.

Getting Started

Singing up to FreeTrade is ridiculously easy. You need a few things to prove you are who you say you are, and then you need to set a designated account for sending and reviewing top ups and pay outs - so do not choose one which you're planning to use for a current account switch in a few months! We both have our Monzo accounts connected to FreeTrade because they're our 'spending' accounts and not our main bank accounts. When you have all of that to hand, don't forget to bag your free share by clicking through our referral link, and then just complete the sign up process on your phone.

Which account type do I want?

Well you have a choice here. If you don't have a stocks and shares ISA elsewhere and you're going to be investing a bit of money, then it's worth getting an ISA. They cost £3 per month, but assuming you have enough invested and you expect your money to grow considerably over the long term we'd say it's worth the money. If that's not for you, then opt for a General Investment Account (GIA). Just be careful though because if you have significant gains on your money or receive a lot of dividends, you will need to declare your profits to the tax man in future.

The other choice you need to make is between FreeTrade basic and Plus. Here, Amy has a basic account and James has a Plus account. The difference is that FreeTrade has made more obscure stocks part of their Plus universe to earn them a little more money - but hey, it's free otherwise, so who can blame them! Amy keeps her investments simple, whereas because of his interests, James looks for these obscure stocks, so it's worthwhile for him.

What on earth can you invest in?

Well that's the great thing about investing, you can opt for almost anything! This is where you need to do your research and understand the different types of investments. If you don't know what the difference is between a stock and an ETF, we'd say you should probably do some more research!

How do I make sure my money is invested ethically?

That's a really difficult question and we'll answer it in two parts.

If you're like James and prepared to research the companies you're buying shares in then do your research and it will be clear if the company is ethically minded or not. The difference between a green energy generating REIT like Greencoat Wind and an oil pipeline REIT should be relatively self-explanatory, but with someone like Apple you might like their principles, but might not like their supply chain. That's fine, but it's a very personal decision.

If you're not so interested in choosing individual shares, or you would prefer to track the market, you can choose to invest in ETFs. These Exchange Traded Funds essentially own a range of companies; sometimes only a few and sometimes thousands depending on their size and focus area. James wants his investments to be more socially responsible and exclude things like tobacco companies, so he owns some of iShares' ETFs which are available on FreeTrade such as: Emerging Markets ESG, Japan SRI and MSCI Europe SRI to name a few. These have the benefit of doing the screening of the companies who are the worst sinners and leave us with mostly good eggs. Do look at the fine print though because there's a US SRI fund which has plenty of oil companies in there too!

How's that been working out for you guys anyways?

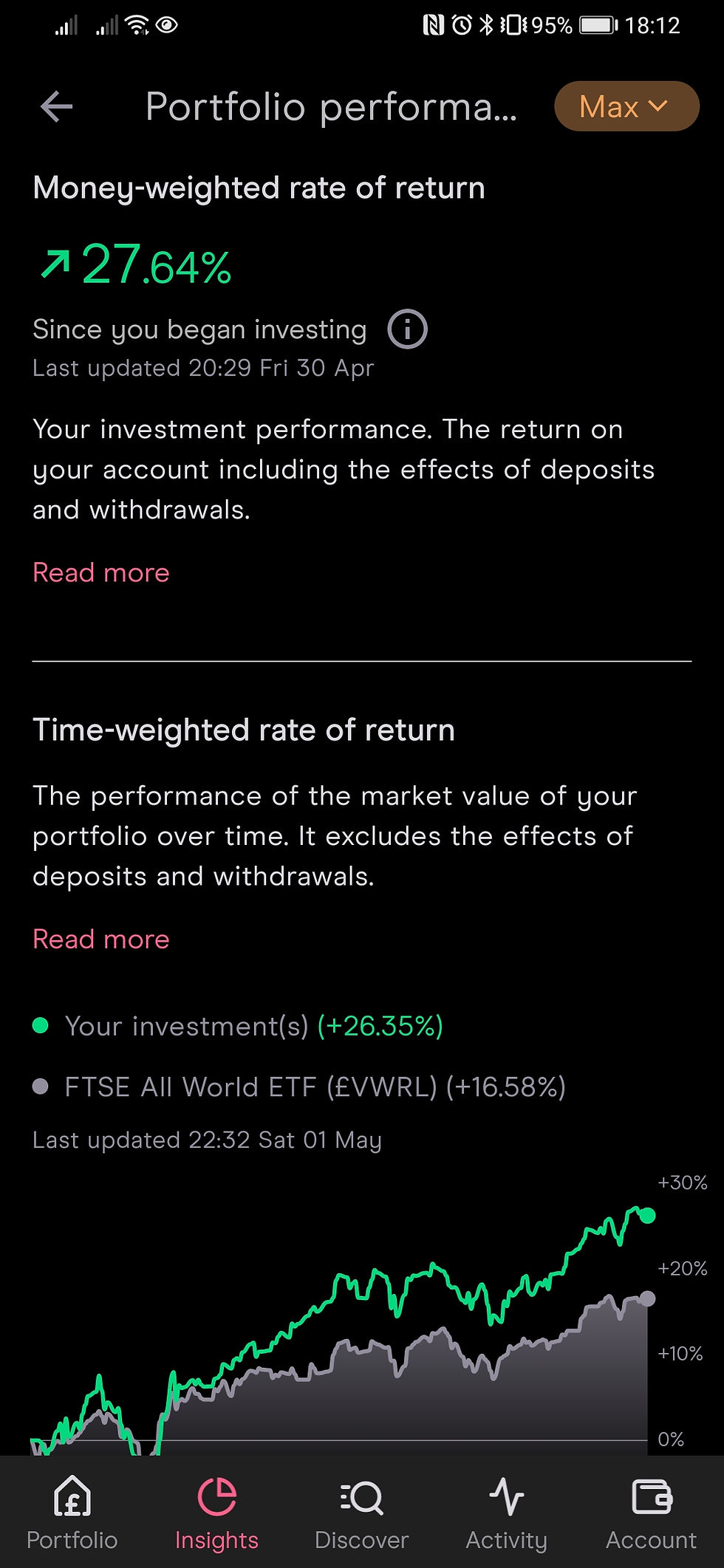

Well James set up his accounts in September 2020. This last year has been crazy and we can't use this year's performance as any indication of the future, but as of May 2021, James is up 26- 27% depending on what metric you use to calculate your return. We know we could lose everything tomorrow, but if you compare that with our best savings account earning 0.5% at the moment, then the difference is stark.

While we acknowledge that investing isn't for everyone, it's well accepted that over the long term the average returns from investing are about 8% per year once all the ups and downs have been evened out.

Why doesn't everyone do this?

We've been thinking about it and we honestly think it's a lot to do with the standard of financial education in our country. No one talks about this sort of thing and unless your parents teach you or you have an interest then you'll never even know this world exists.

Ironically if you have a workplace pension with Aviva or Scottish Widows, someone like that, your money will already be invested in the stock market, but you just won't necessarily realise.

The Wrap-Up

We honestly think FreeTrade is a great platform, we think investing is really interesting and being able to use your money to make a difference and have that benefit you at the same time is fantastic.

We highly recommend you do thorough research before investing and don't invest more than you can afford to lose.

If you do want to get started, don't forget to claim your free share with FreeTrade worth between £3 and £200 by using our link here.

Comments