Circa5000 (Was Tickr) Review - Ethical Investments on Autopilot

- Fussy Vegans

- Feb 16, 2021

- 3 min read

Updated: Sep 13, 2021

With interest rates at all time lows and with less places for us to spend money during the pandemic, there's a lot of very fortunate people who have been able to build up savings. The problem is where to keep this money so that it's working as hard for you as possible.

If you fancy investing the money, you can opt for a DIY platform, like Freetrade (use our link to get a free share worth up to £200!), you could go for a fully managed robo-investor like Wealthify (Review here) or you can go for something in the middle like Tickr.

Tickr have carefully selected some ETFs (Exchange Traded Funds) from a variety of socially responsible themes. You can opt for either a People focus which includes companies who focus on education, healthcare and cybersecurity, a Planet focus which focuses on renewable energy, clean water and sustainable food or a mix of the two.

What Circa5000 Invests in

We opted for the People & Planet mix. You can see in the image to the right that there's a really nice mix of investments in there. You get exposure to Exchange Traded Funds which focus on Digitalisation (the transition to computers), Aging Population, Gender Equality, Clean Energy, Global Water and then Automation & Robotics. Outside of these stocks and shares investments, there's also exposure to green and government bonds to help add some stability too.

As you can see, the last year has seen some exceptional performance across all of the options, but it's worth bearing in mind that this is exceptional given everything that's been going on during the pandemic and with the Biden administration's green recovery plan helping to drive the Clean Energy ETF higher.

Fees and Risk choices

Circa5000's fees are really simple. There's a £1 monthly charge and if your balance is below £3,000 there's nothing else to worry about on Circa5000's side. If you have a balance of over £3,000 you will also be charged a platform fee of 0.30% p.a. on any money above £3,000.

The only other costs incurred are not from Circa5000, but from the provider of the underlying investments. This varies based on your choice of theme (People, Planet, People & Planet) and your Risk (Adventurous, Balanced, Cautious), and they vary between 0.25-0.65% p.a.

The risk levels mentioned above inform the percentage of bonds and shares in your portfolio - in our example above we have the adventurous plan - we feel we're young enough to go for the high risk options with the scope for largest rewards.

If you'd like to you can set up round up spending within the app too to put your extra saving on autopilot. The way it works is when you spend £2.40 the app will take the extra 60p and invest it for you. It's a really good stealth way to squirrel money away without thinking about it.

Planting Trees and Carbon Offsetting

The things which make Circa5000 really unique in our book are the Tree planting and carbon offsetting.

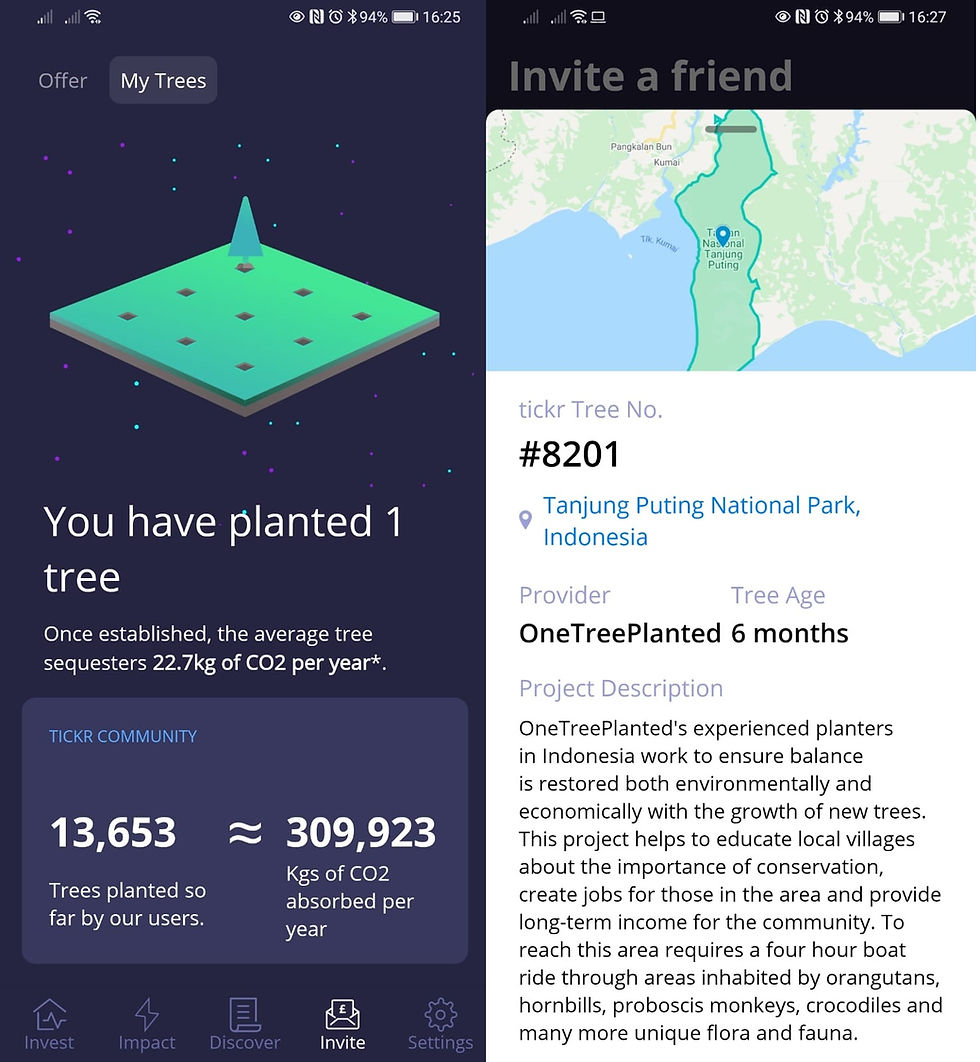

The company has partnered with One Tree Planted (The same people we use to carbon offset our website hosting - we plant our trees in Scotland though!) and they plant a tree for every friend you refer to their platform. As you can see our first tree is now 6 months old and lives in then Tanjung Puting National Park in Indonesia.

One feature we really like is seeing exactly where you tree has been planted and how much CO2 you and the Circa5000 community has helped sequester so far.

You can also choose to pay to pay to carbon offset your life more generally within the app. We haven't chosen to do this, but you can see some of the stats from the rest of the community within the app.

The Wrap Up

Overall we think the app is a really good introduction to ethical investing. The fee structure is simple and good value and it's something you can set up a monthly payment for and forget about. The tree planting is something unique for services like this too.

If you'd like to get started we have a fantastic bonus for you! You get a free £15 bonus if you invest £5 for 90 days and they'll also plant a couple of trees too. Get started using our unique link here.

Comentarios